Every company has employee absences - whether due to vacation, sickness or other reasons. To ensure correct payroll accounting, it is important that the tax consultant is regularly informed about these absences. But how can this process be made efficient and error-free? In this article, we will show you how you can use foreknown to ensure simple recording for employees and efficient provision of all relevant absence data for the tax consultant in clear and customizable employee reports.

The following absence data is relevant for payroll accounting:

- Vacation: Number of leave days taken and remaining per employee.

- Sick Leaves: period of incapacity for work, if applicable with information on a certificate of incapacity for work (AU).

- Special Leaves: Additional vacation days, e.g. due to marriage, death in the family or other personal reasons.

- Maternity Protection / Parental Leave: Absences due to maternity protection or parental leave.

- Unpaid Leaves / Leaves of Absence: Periods during which the employee is released from work without continued payment of remuneration.

Challenges

As a rule, this information must be available to the tax consultant on a monthly basis, at the latest by the payroll run. However, many companies face the challenges that the absence data

- is not available on time.

- have to be compiled manually in Excel spreadsheets.

- can often only be transmitted to the tax consultant very late.

As a result, errors can creep into payroll accounting, which in the worst case can have legal and financial consequences.

Solution

These challenges can be mastered perfectly with the new functions of foreknown Release 2.16.

Absence Types & Reasons: The different absence types can be mapped in foreknown in accordance with the legal requirements. For this purpose, there are the basic absence types "Vacation", "Sick Leave", "Overtime Reduction", "Informative" and "Other Absences".

In addition, individual absence reasons can be defined for each absence type, e.g. to differentiate between "with sick leave" and "without sick leave" for sickness notifications.

These reasons for absence form the basis for the subsequent recording and evaluation of absences.

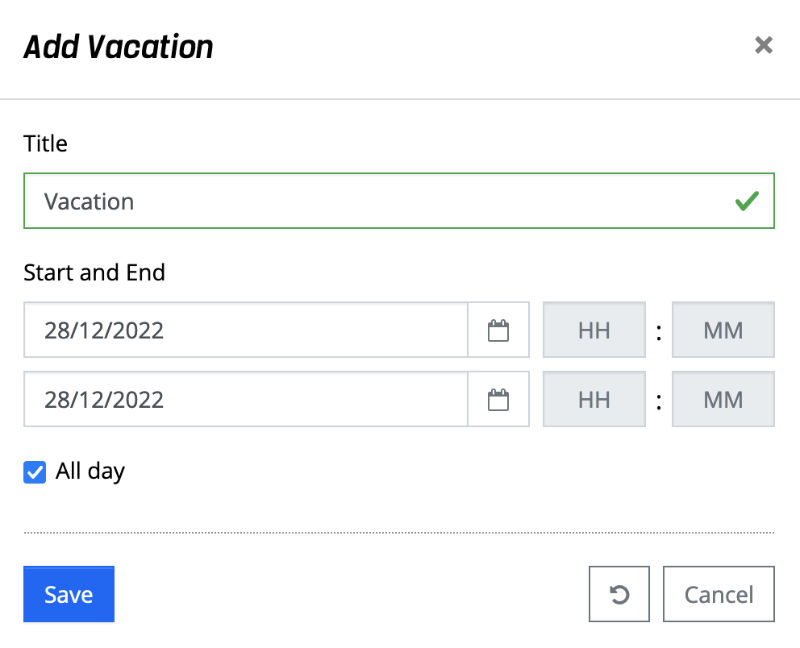

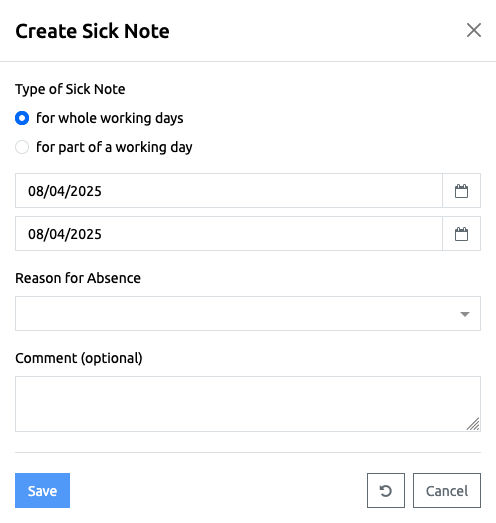

Easy Recording: Furthermore, it is important that all employees can record their absence data easily and correctly to ensure fast, complete recording on the key date. To this end, new dialogs have been created for recording vacation and sick leaves in time recording, which now also take into account the individual reasons for absence and other contractual default settings.

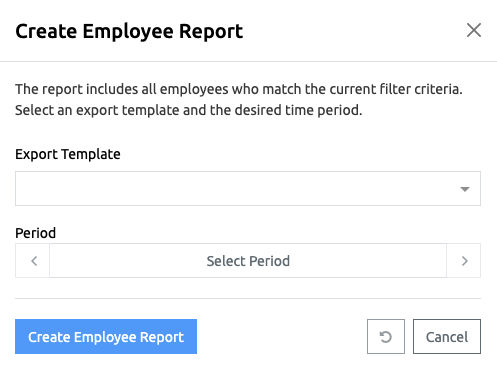

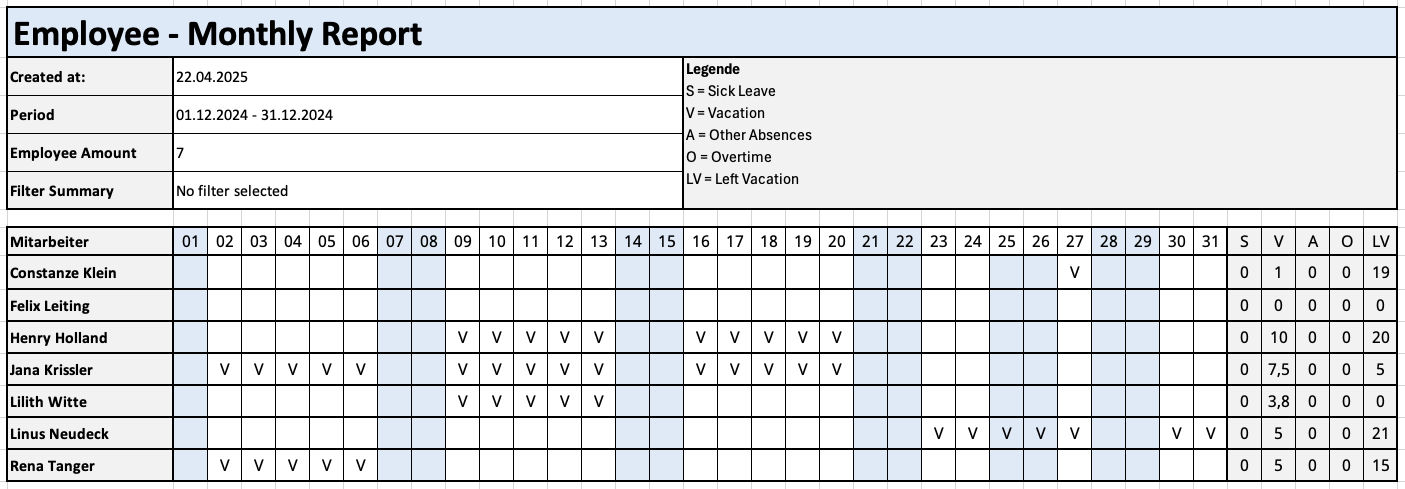

Employee Reports: In order to export the relevant data for payroll accounting, a new Excel template for a month-based employee report has been provided in the current release, which takes into account the stored reasons for absence and can be adapted to individual requirements.

In this way, the absence data for a selected month is exported as a clear Excel table.

Conclusion

The configurable reasons for absence, the simpler recording of absences and the customizable monthly employee reports mean that all relevant data can be exported for payroll accounting at the touch of a button. This means that absence data can be recorded more quickly and exported to Excel more easily, thus eliminating manual errors.

Documentation Links